On the morning of June 28, China Evergrande announced that Top Shine Global Limited of Intershore Consult (Samoa) Limited filed a winding-up petition against the company to the High Court of the Hong Kong Special Administrative Region on June 24, 2022. The amount of financial obligations involved in the company is HK$862.5 million.

Evergrande responded that the company will vigorously oppose the petition, and the petition is not expected to affect the company's restructuring plan or timetable.Evergrande reiterated that the company has been actively communicating with creditors to promote overseas debt restructuring, and is expected to announce the preliminary plan for overseas debt restructuring before the end of July.

According to the relevant regulations, if China Evergrande is eventually wound up as a result of the above petition, any disposition of property directly owned by the company after the commencement date of the winding-up (24 June 2022) (excluding property owned by subsidiaries) ), any transfer of shares in the company or any change in the status of shareholders of the company will be null and void unless an order of recognition is granted by the High Court.If the above petition is withdrawn, dismissed or permanently stayed, the relevant disposition, assignment or change will not be affected.

The board of directors of Evergrande reminds shareholders and potential investors that if the company is eventually wound up due to the above petition, the transfer of China Evergrande shares made on and after the start date of the winding-up will be invalid without a High Court approval order.

In addition, Evergrande disclosed in the announcement that the petitioner was represented by Lian Haomin.

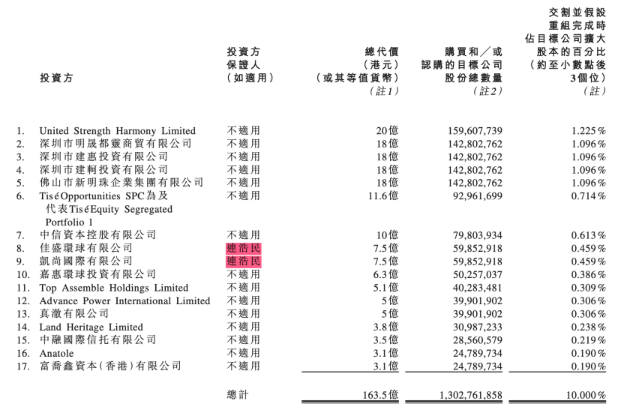

"Lian Haomin" appeared in Evergrande's announcement on "Introducing Strategic Investors to RV Bao" issued on March 29, 2021, and acted as the guarantor of investors Jiasheng Global and Kaishan International.The total investment consideration of the two investors is HK$750 million each.

According to the announcement, Jiasheng Global is a company incorporated under the laws of Samoa, mainly engaged in investment holding, and the ultimate beneficial owner is Lian Haomin; Kaishan International is a company registered under the laws of the British Virgin Islands, mainly Engaged in investment holding, it is wholly owned by a separate investment portfolio under Dasheng Asset Management.Lian Haomin is the founder of Dasheng Asset Management and Dasheng Securities.

The above-mentioned RV Bao announcement also mentioned that if RV Bao fails to be listed within 12 months after the delivery date (or a later period agreed by the parties), each investor has the right to require the relevant obligated parties to jointly and individually The investor pays 115% of the original price to repurchase the RV Bao shares held by the investor.

According to the VAM agreement, RV Bao failed to be listed within the agreed time limit and needed to repurchase the shares held by Top Shine Global at a consideration of HK$862.5 million, which was consistent with the amount involved in the winding-up petition filed by Top Shine Global.