China Economic Net, Beijing, June 28, today, Jingwang Electronics (603228.SH) stock price rose, as of the closing price of 24.74 yuan, an increase of 1.81%, an amplitude of 3.33%, a turnover rate of 0.81%, a turnover of 166 million yuan, and a total market value 21.070 billion yuan.

Yesterday evening, Jingwang Electronics issued an announcement on the public issuance of A-share convertible corporate bonds. The total amount of the company's public issuance of A-share convertible corporate bonds does not exceed RMB 1,160,000,000, and the term is 6 years from the date of issuance.The convertible corporate bonds and future A-shares will be listed on the Shanghai Stock Exchange.

According to the relevant laws and regulations, combined with the company's financial status and investment plan, the total amount of funds raised from the convertible bonds to be issued this time does not exceed RMB 1.17 billion. After deducting the financial investment factor of RMB 10 million from the raised funds, The total amount of funds raised by the proposed issuance of convertible corporate bonds will be reduced to no more than RMB 1,160,000,000. The specific amount of funds raised will be determined by the company's board of directors authorized by the company's general meeting of shareholders within the above-mentioned amount.

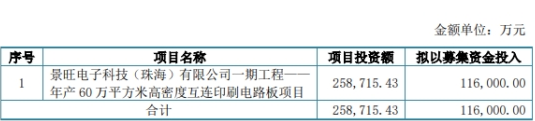

The funds raised from the convertible bonds to be issued by Jingwang Electronics this time will be used for the first-phase project of Jingwang Electronic Technology (Zhuhai) Co., Ltd. after deducting the issuance costs - a high-density interconnection printed circuit board project with an annual output of 600,000 square meters.

The method of determining the coupon rate of the convertible corporate bonds issued by Jingwang Electronics this time and the final interest rate level of each interest-bearing year shall be submitted to the company's shareholders' meeting to authorize the board of directors to communicate with the sponsor ( Lead underwriter) to negotiate and determine.

The convertible corporate bonds issued by Jingwang Electronics adopt the method of paying interest once a year, and the starting date of interest accrual is the first day of issuance of the convertible corporate bonds.

The initial conversion price of the convertible corporate bonds issued by Jingwang Electronics this time shall not be lower than the average trading price of the company's stock in the 20 trading days prior to the announcement of the prospectus (if the stock price has occurred due to ex-rights and ex-dividends within the 20 trading days) In the case of adjustment, the closing price on the trading day before the adjustment shall be calculated according to the price after the corresponding ex-rights and ex-dividend adjustments) and the average trading price of the company's stock on the previous trading day, and shall not be revised upwards.The specific initial conversion price shall be determined by the board of directors of the company authorized by the shareholders' meeting to negotiate with the sponsor (lead underwriter) according to the specific conditions of the market and the company before the issuance.The average trading price of the company's stocks in the previous 20 trading days = the total trading volume of the company's stocks in the previous 20 trading days / the total trading volume of the company's stocks in the 20 trading days; the average trading price of the company's stocks on the previous trading day = the company's stock trading on the previous trading day Total stock traded/Total stock traded of the company on that day.

Jingwang Electronics said that the completion of the investment project with the raised funds will greatly increase the company's asset scale.The total planned investment of this project is RMB 2,587,154,300, of which, the investment in fixed assets is RMB 2,416,320,500 (tax included).As of March 31, 2022, the company's total assets were 14,228,148,200 yuan, and the book value of fixed assets was 5,750,553,600 yuan. With the gradual completion of investment in fundraising projects, the company's total assets and fixed assets The increase in scale will further enhance the company's ability to resist risks. capacity, the company's operating scale and operating efficiency will also be further improved.