Beibu Gulf Insurance Society recruits general manager to become a regular!

Recently, Beibu Gulf Insurance announced that the company appointed Wang Jianwei as the general manager for a term of office until December 31, 2024.Recently, Beibu Gulf Insurance announced that the company appointed Wang Jianwei as the general manager for a term of office until December 31, 2024.

General Manager Wang Jianwei's identity "official announcement"

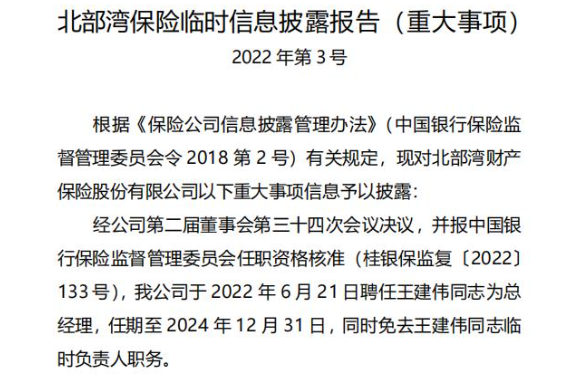

On June 28, Beibu Gulf Insurance announced that, after the resolution of the company's board of directors and the approval of the China Banking and Insurance Regulatory Commission's qualifications, the company will appoint Wang Jianwei as the general manager on June 21, 2022, and the term will expire on December 31, 2024. Go to Wang Jianwei's interim person in charge.

(Image source: Beibu Gulf Insurance Bulletin)

His resume shows that Wang Jianwei was born in September 1971, graduated from Hunan University majoring in finance, doctoral student, associate professor.He has worked in Huaan Property & Casualty Insurance for many years, and served as Assistant General Manager, Deputy General Manager (presiding over the work) of the Strategic Development Department of Huaan Property & Casualty Insurance, Deputy General Manager of Shenzhen Branch, Interim Head of Shanxi Branch, Deputy General Manager (presiding over work) , General Manager of Fujian Branch, General Manager and Vice President of Zhejiang Branch.Before joining Huaan Property & Casualty Insurance, Wang Jianwei taught in the Department of Finance and Insurance of Hunan University of Finance and Economics and the Department of Finance and Insurance of Hunan University (merged with the former Hunan University of Finance and Economics).

Wang Jianwei's appointment stemmed from a large-scale market-based recruitment of corporate executives by Beibu Gulf Insurance.In November 2011, Beibu Gulf Insurance issued a high-level job recruitment announcement. In order to meet the company's high-quality development needs, it selected 1 general manager and 3 deputy general managers through national open recruitment.According to the recruitment announcement, in addition to the position of general manager, in addition to having more than 8 years of financial work experience or more than 10 years of economic work experience, senior managers who have held the position of general manager or above of a provincial branch of an insurance company for more than 5 years or are mainly responsible for the insurance company department In addition to the conditions of being a person for more than 5 years, it is also proposed that candidates should be familiar with the operation and management of modern insurance companies, have a deep understanding and grasp of the strategic goals, realization paths, and key control elements of small and medium property insurance companies, and have a clear understanding of the development of the property insurance market. Research and judgment requirements.

More than 2 months after the public announcement of the recruitment information, Beibu Gulf Insurance issued an announcement that the former general manager Chen Shan resigned, and the proposed general manager Wang Jianwei was the temporary person in charge.

Loss problem to be solved

It is reported that Beibu Gulf Insurance was established in January 2013, with Guangxi Financial Investment Group as the main sponsor, and a total of 13 large enterprises inside and outside the region. It is the first national legal person insurance institution headquartered in Guangxi.

In 2016, Beibu Gulf Insurance, which was established only 3 years ago, entered a period of profit, but it will make a loss in 2021.According to the enterprise early warning link, its insurance business income from 2016 to 2020 was 1.497 billion yuan, 2.048 billion yuan, 2.833 billion yuan, 3.088 billion yuan and 3.608 billion yuan, and its net profit was 45 million yuan, 81 million yuan, 1 million yuan RMB 100 million, RMB 50 million and RMB 106 million.But by 2021, the insurance business income and net profit of Beibu Gulf Insurance will both decline, reaching 3.587 billion yuan and -159 million yuan respectively.In the first quarter of this year, the company's net profit loss was 95 million yuan.

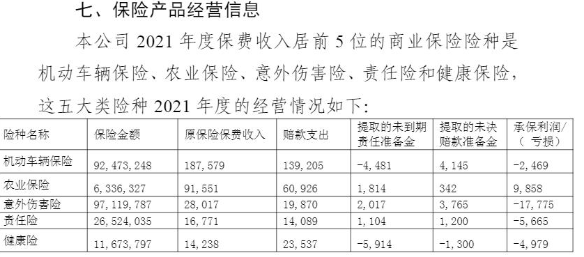

Judging from the annual report data, the top five insurance types of Beibu Gulf Insurance in 2021 are motor vehicle insurance, agricultural insurance, accident insurance, liability insurance and health insurance.Among the above five major types of insurance, only agricultural insurance realizes underwriting profit, and the rest are underwriting losses.Among them, the accident insurance premium income was 280 million yuan, and the underwriting loss was as high as 178 million yuan.

(Image source: Beibu Gulf Insurance Annual Report 2021)

Beibu Gulf Insurance stated in its annual report that in 2021, due to factors such as comprehensive auto insurance reform, business structure adjustment, and high compensation in each business segment, various indicators of business development planning, especially the achievement of profit and compensation cost indicators, have certain strategic risk preferences. deviation.

The company's solvency report for the first quarter of 2022 shows that in the first quarter of this year, Beibu Gulf Insurance had a net loss of 95 million yuan; the core and comprehensive solvency adequacy ratios were 173.14% and 214.6%, respectively; the comprehensive risk rating was lowered from Class A in the third quarter of 2021. Class B for the fourth quarter of 2021.

It is worth mentioning that the actual capital and minimum capital reinsurance of Beibu Gulf Insurance in the first quarter of this year decreased by 126 million yuan and 134 million yuan. The reasons given by the company are that the operation in the first quarter was in a loss state, and the old and new rules were updated.

Capital increase plan on hold

In November 2021, Beibu Gulf Insurance plans to prepare for capital increase and share expansion. Zhongheng Group (600252) plans to contribute no more than RMB 450 million and subscribe for no more than 300 million shares to participate in the capital increase and share expansion plan of Beibu Gulf Insurance.At the same time, Zhongheng Group also announced that it plans to subscribe for the "2021 first phase of capital supplementary bonds" to be issued by Beibu Gulf Insurance, with a subscription amount not exceeding 100 million yuan.

However, Zhongheng Group's capital increase and bond subscription plan for Beibu Gulf Insurance "died" only half a month after it was approved by the board of directors.

Not long after the above-mentioned capital increase plan was released, Zhongheng Group received an inquiry letter from the Shanghai Stock Exchange.The inquiry letter pointed out that in recent years, Zhongheng Group has participated in a number of non-public offerings of affiliated companies and the establishment of funds, etc., and affiliated transactions are relatively frequent.The main business of Zhongheng Group is pharmaceutical manufacturing, and Beibu Gulf Insurance is a property insurance company. The two industries are quite different.The inquiry letter requires Zhongheng Group to further verify and supplement the disclosure on issues such as "the necessity and rationality of this connected transaction" and "whether financial investment is the direction of business development".

In December of the same year, Zhongheng Group issued an announcement that it believed that the amount involved in the related transactions of Beibu Gulf Insurance's capital increase and share subscription and the subscription of capital supplementary bonds was relatively large, and the matters were relatively complicated, and investors and the market were highly concerned, and decided to terminate the participation in Beibu Gulf. Related transactions of insurance capital increase and share subscription and subscription of capital supplementary bonds.