Beer marketing battle: online promotion and offline competition in multiple scenarios

In order to maintain market advantages, beer companies have accelerated the layout of diversified channels and created new marketing methods in multiple fields

"We strongly believe in the consumption potential of the Chinese market, and also believe that the growth in the number of middle-income households in China will continue to drive consumption growth." Yang Ke, CEO of Budweiser Asia Pacific, expressed his confidence in the Chinese market in a recent speech.As an international brewer deeply cultivating the Chinese market, Budweiser Asia Pacific is trying to accelerate the layout of digital platforms.

China Resources Beer has enriched its high-end sales force, promoted the construction of a major customer platform, and continued to cultivate and promote key brands with the help of well-known sports events and themed marketing channel activities.China Resources Beer revealed that, benefiting from the above actions, its sales of high-end and above beer in 2021 will increase by nearly 30% year-on-year, and the product structure will be significantly improved.

Under the new market situation brought about by the epidemic, beer companies continue to adjust their strategies from channels to marketing and seek more diversified development paths.As channel terminals, taverns and catering practitioners also use more diversified marketing methods and sales channels to explore new performance growth points.

Looking at the entire beer industry, both giants and new entrants are embracing the diversified layout in the new era while stabilizing key markets.

Accelerate the expansion of online channels

Budweiser Asia Pacific 2021 annual report shows that despite the impact of the epidemic, its sales revenue still achieved a growth of 14.9%, especially in the Chinese market.Budweiser Asia Pacific stated that it performed strongly in China in the fourth quarter of 2021, with significant growth in sales volume, revenue and market share, surpassing pre-pandemic levels, with sales volume and revenue increasing by 8.5% and 19.7% respectively.

The management of Budweiser Asia Pacific analyzed that the growth came from the research and development of new products to meet the differentiated needs of consumers. On the other hand, digital transformation has become a bright spot, among which the BEES business-to-business (B2B) platform has been launched.

BEES mainly uses technology and expertise to help dealer customers optimize operations.Budweiser Asia Pacific said that as of December 2021, more than 500,000 customers had adopted BEES' trade marketing investment and digital interaction modules.Budweiser Asia Pacific plans to expand BEES to 10 cities in the first half of 2022, and to 60 cities across the country by the end of the year, trying to continue to develop digital solutions for wholesaler partners and customers to increase sales and accelerate geographic expansion.

Another beer brand, Yanjing Beer, continues to carry out an integrated online and offline marketing strategy, selling products through multiple e-commerce platforms, and it is quite targeted, such as Yanjing U8, Yanjing Pure White Beer, Yanjing Fresh Beer, Yanjing Bajing Craft Brew, etc.

A reporter from the Beijing News found on the official account of Yanjing Beer Douyin that Yanjing Beer uses different products as the main title and combines different themes to create small theaters suitable for short video dissemination, such as "U8 Theater" and "You Theater".Yanjing Beer revealed that although the current sales of e-commerce sales channels only account for 0.72% of the company's total sales, the growth rate is relatively fast.In 2021, the operating income of e-commerce channels will increase by 36.17% year-on-year, much higher than the 11.82% growth rate of traditional channels.

Pearl River Beer is also promoting the in-depth integration of online and offline consumption. On the one hand, it has opened more than 20 Pearl River Beer chain experience stores in the Guangdong-Hong Kong-Macao Greater Bay Area to achieve rapid online and offline response to consumer demand.On the other hand, it focused on the hot spots of festive consumption, and strengthened the theme activities such as the New Year's Day and e-commerce member welfare activities online.Data shows that in 2021, Pearl River Beer's e-commerce channel will achieve operating income of 33.178 million yuan, a year-on-year increase of 34.97%, far exceeding the 5.31% growth rate of ordinary channels.

Beer companies use multiple means to develop online channels, which also extends the competition of beer brands to alcohol e-commerce platforms.The ranking of beer brands in alcohol e-commerce platforms reflects the online marketing achievements of beer giants to a certain extent.

A reporter from the Beijing News learned from the alcohol e-commerce platform 1919 that in February 2022, the sales of beer products on the platform fell by 13.56% year-on-year; in March, the sales of beer products increased significantly by 73.11% year-on-year; in April, the increase became 72.57% %.On this platform, well-known brands such as Fujia, 1664, Budweiser, Fanjiale, Wusu, Corona and Qingdao entered the top ten sales.

According to data provided by Walmart stores, in the past year, the online sales of beer in Walmart hypermarkets were 1.5 times that of the previous year.Qingdao, Budweiser, Snowflake and Harbin are still the most popular beer brands.The sales volume of craft beer has increased significantly, and the sales volume in 2021 is more than double that in 2020.The craft beer brands that are at the forefront of consumer preference include 1664, Fuka, Bolong, Dewey, and Chimei.

Some craft breweries and brands are also accelerating their efforts to develop online channels.Great Leap Craft Brew, a craft beer brand, told the Beijing News that dine-in stores were temporarily suspended due to the epidemic, but the development of takeaway and delivery business exceeded expectations.In response to this trend, Great Leap Craft Brewing started its online business with one-liter take-out beer, and is currently upgrading its online business to a bottling mode.

The surge in beer sales on online platforms shows that online channels have the potential to become an important way for the beer consumer market to hedge against the impact of the epidemic.

Offline diversification meets opponents

Although beer companies continue to develop online channels, offline channels are still the absolute main source of revenue.

The operating income of Yanjing Beer's traditional channels reached 10.649 billion yuan. The revenue of Zhujiang Beer's e-commerce channel is not only far lower than the ordinary channel revenue of 4.093 billion yuan, but also lower than the night market channel revenue of 88.5569 million yuan.

The epidemic has damaged the offline channels of beer companies, and they have sought more diversified development channels to achieve balance and diversification of sales channels.

On April 30 this year, Helens, the "first share of the bistro", announced the opening of 11 new stores.Ublau Craft Beer also announced on its official WeChat account on May 7 that it will open 19 new stores during the May Day period.

Tsingtao Brewery mentioned in its 2021 financial report that due to the impact of the epidemic during the reporting period, ready-to-drink markets such as catering and nightclubs accounted for about 44.4% of the company's market sales; %.The company is exploring online and offline three-dimensional multi-link business, building an "Internet +" channel system, and promoting O2O, B2B, community group buying and other businesses.

Huiquan Beer will gradually enter high-end restaurants and nightclubs in 2021 to achieve brand enhancement and sales growth.During the reporting period, the sales volume of catering channel products accounted for 26%, with a year-on-year increase of 10%. Strategic single products were effectively promoted in the catering industry, and mid-to-high-end products became the company's mainstream sales products for catering consumption, with a sales increase of 32%.

It is worth mentioning that, as a branch of the catering industry, bistros have emerged in the beer sales channel.According to data from consulting agency Frost & Sullivan, the total revenue of the domestic pub industry has risen from about 84.4 billion yuan in 2015 to about 117.9 billion yuan in 2019, with a compound annual growth rate of 8.7%; in 2025, the total revenue of the domestic pub industry It is expected to reach 183.9 billion yuan.At present, more than 95% of the 35,000 pubs are independent pubs.

In order to seize the market, major beer brands are also actively cultivating their own exclusive channels. Beer restaurants and bars represented by Tsingtao Beer TSINGTAO 1903 and Yanjing Beer's "Yanjing Community Liquor" are gradually emerging.

From 2020, Yanjing Beer will test the "Yanjing Community Liquor" small wine house business, and Beijing Qingnian Road Store, Dongba Store, Shunyi Jinghan Store, and Pinggu Store have opened one after another.On April 1, 2021, "Yanjing Community Wine Number" announced that it began to recruit franchisees in an all-round way.

A reporter from the Beijing News visited Beijing's "Yanjing Community Liquor" Chaoyang Shuangjing store in April this year. The store sells party IPA, raspberry wheat, wheat white beer, pure yellow beer, pure lager, etc. The products are all supplied by Yanjing Beer, and customers can dine in or take away.According to the clerk, the tavern is not directly operated by Yanjing, but adopts the form of franchise.

On June 11, a reporter from the Beijing News learned from Yanjing Beer as an intended franchisee that joining "Yanjing Community Liquor" requires a one-time fee of 68,000 yuan. The products sold in the store are exclusively for consumption. Users cannot buy it from other channels, and in principle, other beers are not allowed to be sold in the store.

An expert in the beer industry introduced that this kind of community store is a new channel for beer brands to develop. At present, there are more than 100 community wine stores in Yanjing and more than 200 in Qingdao TINGTAO 1903.

It is understood that Tsingtao Brewery revealed at the 2020 annual performance briefing that it plans to open 400-500 TINGTAO 1903 beer bars by 2023.

However, in the catering channel, traditional beer brands have to face new players - catering companies, such as Haidilao Beer, directly leverage their hot pot restaurant channel to reach consumers.Li Wenjuan, product manager of Haidilao craft beer, told the Beijing News that although Haidilao beer products can also be seen in some supermarket channels, Haidilao hot pot stores are still the main sales channel."For Haidilao Beer, it is necessary to weigh the investment and return of different channels, and the current store can bring the best sales effect and brand influence."

Li Wenjuan said that through hundreds of Haidilao stores, you can immediately understand consumers' feedback on beer products and adjust their product strategies and marketing strategies at any time.If you go through the dealer channel, you need to go through layers of chains, and it is difficult to accurately obtain information such as consumer purchase frequency and purchase volume.

Start marketing for sports and social entertainment

In the exploration of channel diversification of beer companies, sports and social entertainment have become important areas for beer marketing to "compete" for attention.

China Resources Beer uses sports events such as the European Cup and the Champions League, and variety shows such as "This Is Hip-hop 4" to carry out theme promotion and channel marketing activities, and use these activities to promote key brands.In this regard, China Resources Beer stated in its 2021 annual report that the above-mentioned marketing activities will benefit the company in 2021.In 2021, the sales volume of CR Beer's sub-grade and above beer is about 1.866 million kiloliters, an increase of 27.8% compared with 2020, and the product structure has been significantly improved. Get double-digit growth.

In addition, Pearl River Beer advocates healthy life with "beer + sports", and has sponsored the Guangdong Men's Basketball League for 6 consecutive years.Yanjing Beer stated in its 2021 annual report that Yanjing Beer, as a state-owned enterprise of Shuang Olympics, will carry out sports event marketing with the theme of "Meet the Ice and Snow, Hello Winter Olympics".

Lu Weilun, CEO of Great Leap Beer, told the Beijing News that sports competitions and beer are good partners.The brand will use large-scale sports events to do online and offline activities in stores to increase the connection of consumers who are interested in events.If there is no impact of the epidemic, the Qatar World Cup in November this year should greatly promote the sales of stores.A reporter from the Beijing News also noticed when visiting the Great Leap Craft Brewing Store on June 9 that the program played in the store is the UEFA Champions League that football fans love.

Fang Gang, a beer marketing expert, pointed out that sports competitions like the World Cup have little effect on the total sales of beer.However, it can still play a certain role in beer sales in local areas, or beer sales in certain channels.

For example, he said: "For example, some themed restaurants or hotels that have the conditions to broadcast the event may achieve better sales results. In addition, beer and sports are closely related, and events like the World Cup are still important for beer companies' brand promotion. It's stimulating."

Wusu Beer, a subsidiary of Chongqing Beer, is the most direct representative of benefiting from social entertainment.In recent years, Wusu Beer has become popular on social media with the image of "life-threatening big Wusu", coupled with the characteristics of high alcohol content and high malt concentration, it caters to the post-90s, especially the post-00s, who are curious and early adopters.Wusu has also cooperated with well-known figures in the sports and entertainment circles. In 2020, UFC women's world champion Zhang Weili will be invited, and in 2022, Wu Jing, who has repeatedly appeared as a tough guy, will be invited as the brand spokesperson.

According to a research report released by Cinda Securities, Wusu has gradually become popular on social media since the second half of 2018.Under the operation of the Carlsberg team, the sales volume of Wusu in 2021 will be 830,000 kiloliters, a year-on-year increase of 34%.Even in the more competitive southern China market, Wusu's revenue growth rate is still more than 30%.

Consolidate key markets

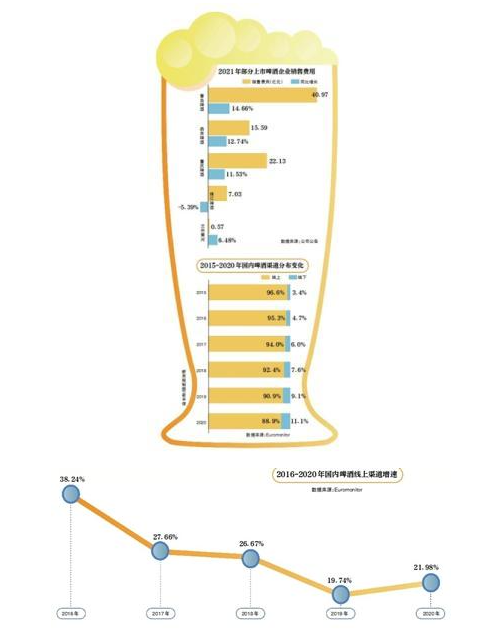

A variety of marketing, so that the sales expenses of beer companies increased.In 2021, the sales expenses of Tsingtao Beer, Chongqing Beer, Lanzhou Yellow River, and Huiquan Beer will reach 4.097 billion yuan, 2.213 billion yuan, 57.316 million yuan, and 27.237 million yuan, up 14.66%, 11.53%, 6.48%, and 6.4% year-on-year respectively.

Tsingtao Brewery stated that the increase in sales expenses in 2021 is mainly due to the increase in sales this year and the company's increased brand promotion efforts.Chongqing Beer said that the increase in sales expenses was mainly due to the increase in market advertising expenses to drive business development.

Strengthening external publicity has become an important action for beer companies to get out of the haze of the epidemic, consolidate existing advantageous markets, and expand new markets.

Tsingtao Brewery stated that in 2021, the company will establish and continue to improve its network layout covering major markets across the country and radiating to the world. Its business covers more than 100 countries and regions around the world. It will continue to strengthen its marketing efforts and deepen the construction of its market and sales network. Optimize the division of labor in the marketing value chain, improve the maintenance and service capabilities for end customers, and consolidate and increase the dominant position in the base market and the share of emerging markets.Tsingtao Brewery achieved operating income of 19.747 billion yuan in Shandong, its largest regional market, and 7.275 billion yuan, 3.366 billion yuan and 2.791 billion yuan respectively in North China, South China and East China.

After the reorganization with Carlsberg, Chongqing Beer, which has become a national beer enterprise, will rely on the brand combination of "local strong brand + international high-end brand" in 2021 to promote the reform of sales model and further strengthen the core competition of local strong brands in key markets. The Company continued to consolidate and improve its position in the core market, and further expanded its high-end advantages, which brought strong growth in revenue per hectoliter for the company; the plan for large cities continued to accelerate, and sales grew rapidly.

According to the data disclosed by the Cinda Securities Research Report, in 2021, the revenue of Chongqing Beer Northwest District will be 4.2 billion yuan, a year-on-year increase of 25.2%; the revenue of the Central District will be 5.3 billion yuan, a year-on-year increase of 13.6%; the revenue of the Southern District will be 3.3 billion yuan, a year-on-year increase of 13.6%. up 28%.

Yanjing Beer also stated that it is necessary to concentrate advantageous resources to continuously enhance regional competitiveness.Its 2021 annual report mentioned that the company will strengthen the advantages of Beijing, Guangxi, Inner Mongolia and other regions, and through the project of the top 100 counties, strengthen the construction of the market development system, increase the intensity of regional market development, and lay out the regional market.

Beijing, Guangxi, Inner Mongolia and other regions are the traditional strong areas of Yanjing Beer.In 2021, Yanjing Beer will achieve operating income of 5.913 billion yuan in North China, accounting for 49.44% of the total operating income; South China will achieve operating income of 3.732 billion yuan, accounting for 31.2%.

The regionality of regional wine companies is even more obvious.Pearl River Beer will achieve revenue of 4.304 billion yuan in southern China in 2021, accounting for 94.86% of total operating revenue; Lanzhou Yellow River will achieve revenue of 231 million yuan in Gansu province, accounting for 74.89% of total revenue.

According to a research report released by Southwest Securities in May, the national beer market has basically established five beer giants, China Resources Beer, Tsingtao Beer, Yanjing Beer, Budweiser and Carlsberg, occupying more than 90% of the market share.The major beer companies have established their own core advantageous areas, and a solid base market will help them stay invincible in the fierce competition.

Southwest Securities analyzed that the high market share of beer companies in advantageous areas can help companies deepen their channel control and resist attacks from foreign brands; the high profit contribution rate ensures that the company's performance is basically stable and provides assistance for structural upgrading; Radiation driving effect on surrounding provinces.As the major giants continue to intensively cultivate the base market, the competition pattern of the beer industry will gradually solidify, and there will be no major changes in the short term.

Written by version B06-B07 / Beijing News reporter Xue Chen

【Editor: Cheng Chunyu】